COVID-19’s impact on real estate advertising on Facebook

Share

Schedule a 30-min marketing strategy call with our team

These are unprecedented times. To overcome this, we must come together as a global community with our resources in order to help however we can. At Evocalize, our contribution means helping our partners and advertisers understand the changing dynamic of real estate advertising on Facebook to make sure they are putting their dollars to good use. To do this we have analyzed a subset of our Facebook media spend within the real estate industry. Our hope is to provide the data, and analysis, needed by agents and brokers so they can make informed decisions about advertising investments in a COVID-19 impacted real estate market.

Framework of the Analysis

Our team completed a month over month analysis (February 2020 vs March 2020) of a subset of our real estate industry media spend on Facebook.

All metrics were taken from listings-based lead generation programs running across Facebook’s family of apps and services, with a 1day attribution window. The data from this subset includes over 160 million ad impressions and behaviors that generated over 70,000 leads. Additionally, advertising programs used in this analysis reached over 100 million in-market buyers and sellers.

Analysis Results

The below chart shows the percentage change in each performance metric.

Note: Some metrics, like CTR, are percentages whereas other metrics, like CPM and CPL, are dollar amounts. This chart simply shows the percentage change in the metric. Let’s explain further using a few examples with easy to use numbers. The -25% change in CTR means that if a CTR started out at 1%, the -25% change means the CTR dropped to .75%. Same concept with the CPL and CPC, if a lead cost $1 in January, it will now cost $1.15 due to the 15% increase in CPL.

Two Key Take-a-Ways

From a Lead Generation Prospective, It’s Almost Business as Usual

The 29% drop in media costs (CPM) is significant. This is due to the increased amount of supply (available ad impressions) generated from the massive amount of people working from home and surfing Facebook. For example, the amount of video views on Facebook Live doubled in just a week.

Another contributing factor is a decrease in advertiser demand. Brands in the most affected industries, like travel, are greatly reducing, if not stopping, advertising efforts. The increase in ad inventory, mixed with the decrease in demand results in a drop-in media rates.

From an engagement standpoint, the analysis shows that engagement with Listing Ads dropped by 25%. This is a significant drop; however, our programs are exceeding industry benchmarks and are producing a CTR well over 4% on average. Our hypothesis of the CTR decrease is that in this environment, in-market buyers and sellers are still browsing and viewing the ads, but with less intent and therefore clicking through less frequently.

Also, the amount of people who clicked on an ad and converted (requesting more information about a listing) decreased by 18%. This decrease disproved an early hypothesis of ours that people who click on ads would be more likely to convert, due to their deeper intention to move through the buying cycle. However, the decrease in CVR does not support this supposition.

The significant decrease in media costs, with the fluctuation in engagement and conversion metrics, leads to a near “business as usual” approach to lead generation. The 15% increase in CPL means that for every $150 the average real estate agent spends on lead ads, they used to get ~8 leads and now they are getting ~7 leads

From a Branding and Awareness Prospective, you get 1.29 impressions for the price of 1

Programs that run branding or awareness objectives are in the limelight right now. The significant drop in media costs create an opportunity to start building new relationships with clients and prospects. This means focusing budgets on top of funnel movement will give you the most value per dollar spent on advertising.

Will CPM and CTR Rates Continue to Fall?

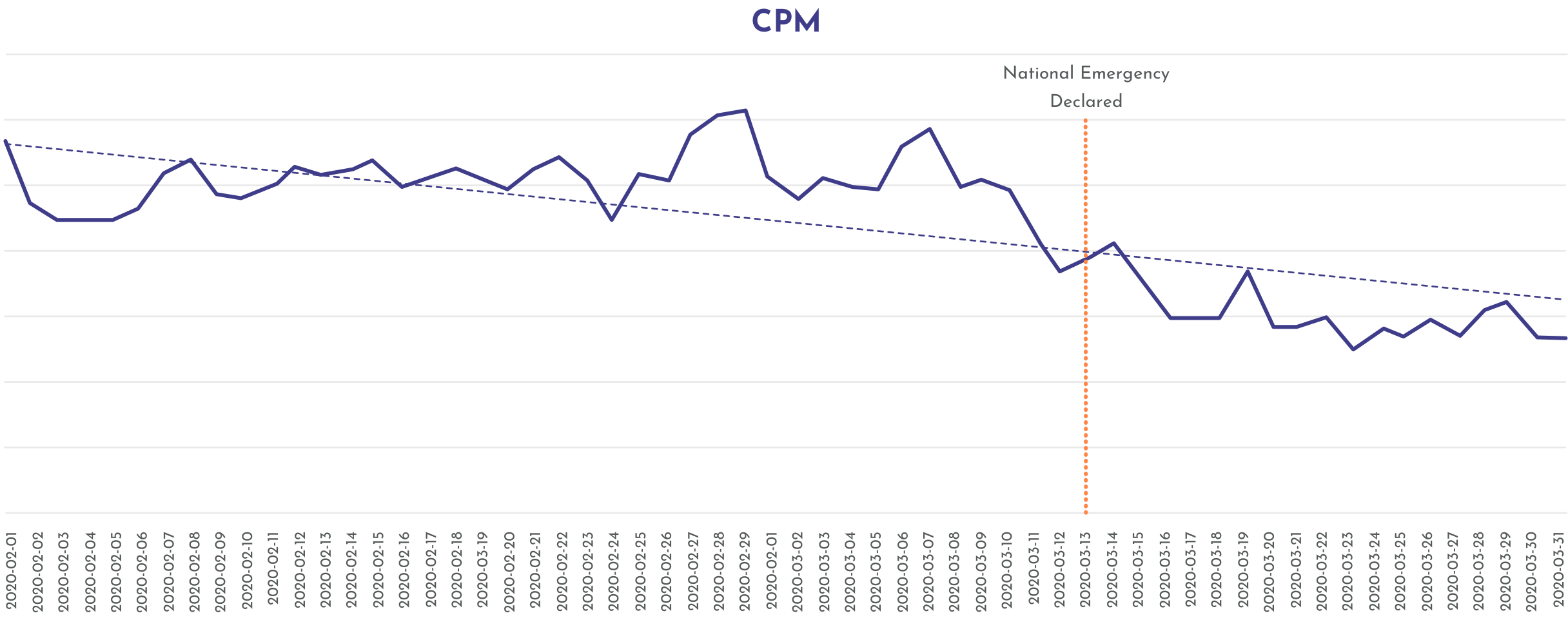

The short answer? It’s too early to tell. You can see in the below CPM trend line that CPM rates appear to be flattening out. We’d predict that CPM rates will remain low over the next few weeks.

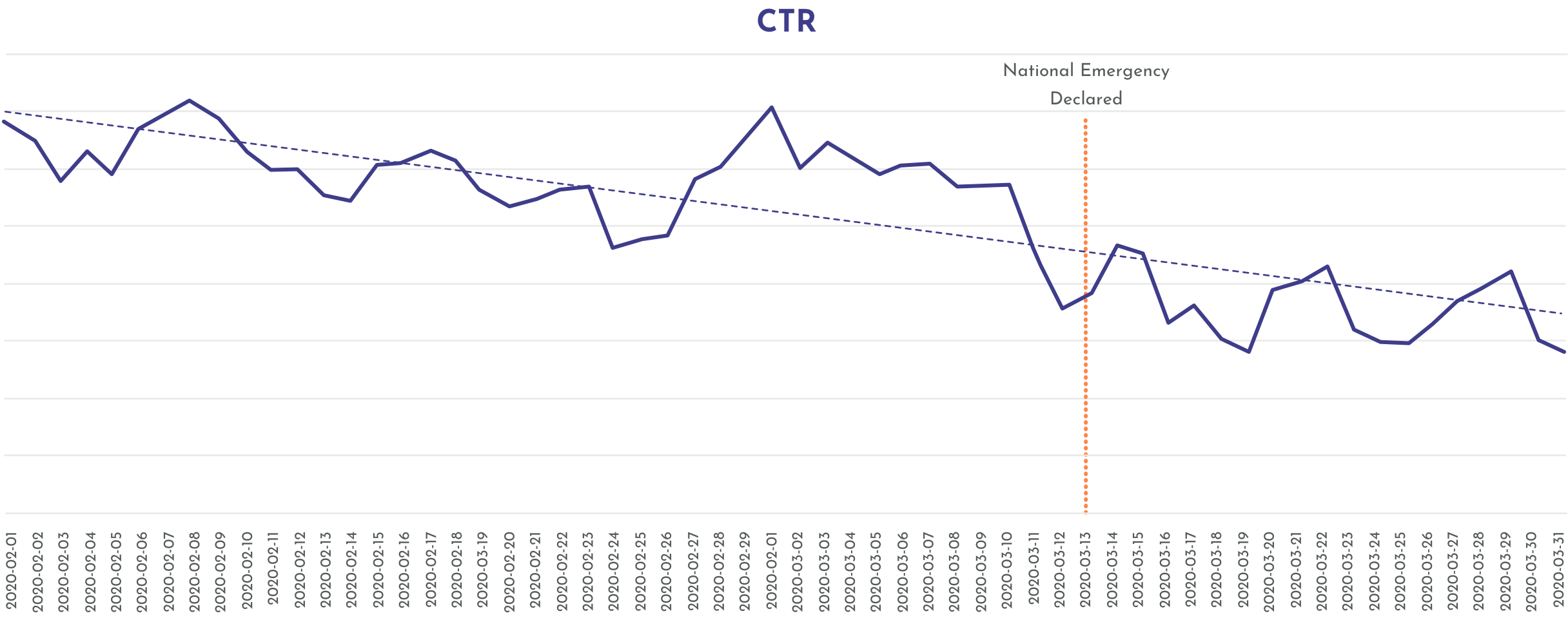

The below CTR trend line also shows that engagement starts to flatten out towards the end of the analysis period. If CTRs start to increase, and media rates stay low, the advantage for brokers and agents will increase.

Share

Subscribe to our blog

Don’t miss a beat in the fast-changing local digital marketing landscape — sign up to stay ahead of the curve!